Worldwide cloud service spending to grow by 19% in 2025

In Q4 2024, global cloud infrastructure services spending rose 20% year on year to US$86 billion. For full-year 2024, spending also grew 20%, up from US$267.7 billion in 2023 to $321.3 billion in 2024. The key driver behind this growth was the expansion of AI models, which significantly accelerated cloud adoption. By the second half of 2024, the top cloud vendors all reported positive returns on AI investments, with AI applications having a notable impact on their overall cloud business performance. As AI market competition intensifies, cloud hyperscalers plan to further expand investments in cloud and AI infrastructure in 2025 to keep pace with rising demand. Canalys forecasts global cloud infrastructure services spending will grow 19% in 2025.

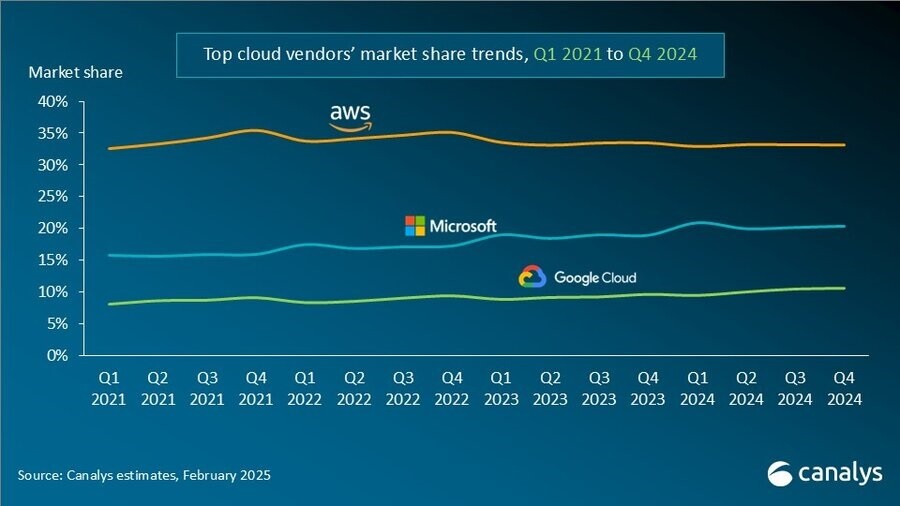

In Q4 2024, the ranking of the top three cloud providers – AWS, Microsoft Azure and Google Cloud – remained unchanged from the previous quarter, with their combined market share accounting for 64% of global cloud spending. Collectively, their total spending grew 25% year on year.

AWS, the market leader, maintained a 19% annual growth rate, consistent with the previous quarter. Meanwhile, Microsoft Azure and Google Cloud suffered a slight decline in their year-on-year growth rates compared with the previous quarter. This slowdown was primarily due to strong AI-driven demand outpacing supply, as the leading cloud providers reported that growth remained constrained by limited capacity, creating a tight supply-demand balance.

As AI becomes more efficient and widely adopted, demand is expected to grow exponentially. In response, cloud hyperscalers are making significant investments to grow AI model training, deployment and cloud-based applications globally. AWS’ capital expenditure hit US$26.3 billion in Q4, with total spending projected to exceed US$100 billion in 2025. Microsoft’s Q4 capital expenditure reached US$22.6 billion, and it plans to invest around US$80 billion in data centers over the fiscal year. Google announced in its Q4 earnings call that it expects its capital expenditure to reach approximately US$75 billion in 2025. “Cloud hyperscalers are investing at an unprecedented rate,” said Yi Zhang, Analyst at Canalys. “The race is no longer just about offering the best AI services – it’s about growing fast while ensuring financial sustainability and long-term competitiveness.”

The AI race remains fiercely competitive, with hyperscalers advancing their proprietary models while rapidly adapting to new market entrants. In January 2025, the Chinese AI startup DeepSeek introduced DeepSeek R1, a model widely regarded as a game-changer for its benchmark performance and cost efficiency. DeepSeek gained global recognition for achieving GPT-4o-level performance at a fraction of the cost. Leading cloud providers responded swiftly, integrating DeepSeek R1 into their platforms almost immediately.

“The rapid adoption of DeepSeek R1 by leading cloud providers highlights its disruptive impact, challenging industry norms with its cost efficiency and high performance,” said Rachel Brindley, Senior Director at Canalys. “As AI evolves, new models will continue to emerge, driving innovation and competition across the ecosystem. Vendors are responding swiftly, ensuring seamless access for customers to explore and integrate the best options.”

Amazon Web Services (AWS) maintained its leadership position in the global cloud market in Q4 2024, securing a 33% market share and achieving 19% year-on-year revenue growth. For full-year 2024, AWS’ cloud infrastructure revenue exceeded US$100 billion, keeping it on top. At AWS re:Invent in December, it introduced AWS Nova, a foundation model available exclusively on Bedrock, offered in three variants: Micro, Lite and Pro. In January 2025, AWS announced the integration of DeepSeek’s latest R1 foundation model into its flagship AI platforms, Amazon Bedrock and Amazon SageMaker. To adapt to the accelerating pace of technological advances, particularly in AI and machine learning, AWS shortened the lifespan of certain servers and networking equipment from six years to five, effective from January 2025. Concurrently, AWS continues to expand its capital investment, most recently committing over US$1 billion to AI-focused data center projects in Ohio and Georgia.

Microsoft Azure remained the second-largest cloud provider in Q4 2024, with a 20% share and impressive annual growth of 31%. Microsoft reported that Azure’s growth included a 13% contribution from AI services, which grew 157% year on year. In December, Azure announced the integration of OpenAI’s latest GPT-o1 model into the Azure OpenAI Service. Notably, GPT-o1 features a multimodal design, enabling both text and visual inputs. In January 2025, DeepSeek R1 was officially released on Azure AI Foundry and listed in GitHub’s model catalog. It is now part of Microsoft’s extensive portfolio of over 1,800 AI models available on these platforms. In December, Microsoft announced the completion of all three Azure availability zones in Saudi Arabia, with operations set to begin in 2026. In February, it revealed plans to invest approximately US$700 million to expand its hyperscale cloud and AI infrastructure in Poland by June 2026.

Google Cloud, the third largest cloud provider, retained an 11% market share and reported strong 32% year-on-year growth. As of 31 December 2024, Google Cloud’s revenue backlog grew to US$93.2 billion, up from US$86.8 billion in Q3. Additionally, the number of first-time commitments in 2024 more than doubled compared with 2023. In December 2024, Google launched Gemini 2.0, its most advanced multimodal AI model, fully powered by TPUs. Two months later, the Gemini 2.0 series – Gemini 2.0, Flash, Flash-Lite and Pro – is fully available via the Gemini API on Google AI Studio and Vertex AI. In December, the company announced the launch of its forty-first cloud region in Mexico, marking its third cloud region in Latin America, following those in Chile and Brazil.

Canalys defines cloud infrastructure services as services providing infrastructure (IaaS and bare metal) and platforms that are hosted by third-party providers and made available to users via the Internet.

For more information, please contact:

Rachel Brindley: rachel_brindley@canalys.com

Yi Zhang: yi_zhang@canalys.com

About Canalys

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.